What is a involuntary lien – What is an involuntary lien? This enigmatic legal instrument takes center stage as we delve into its intricate world, unraveling its complexities with clarity and precision. Prepare to be engrossed in a journey of knowledge that illuminates the nuances of involuntary liens, empowering you with a profound understanding of this often-misunderstood concept.

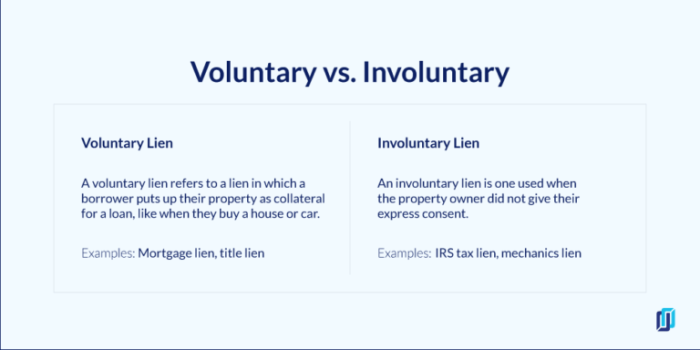

Involuntary liens, unlike their voluntary counterparts, are imposed upon individuals or entities without their explicit consent. They arise from various circumstances, such as unpaid debts, unpaid taxes, or legal judgments. Understanding the nature and implications of involuntary liens is crucial for both creditors and property owners alike.

Definition of Involuntary Lien

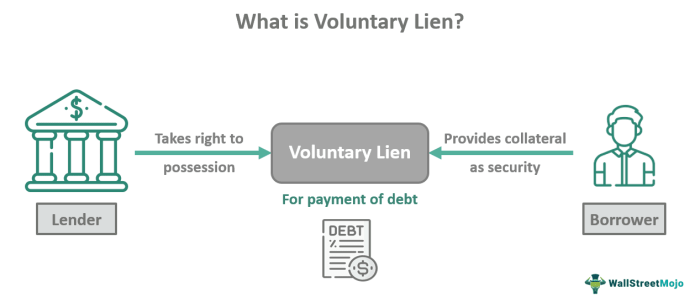

A lien is a legal claim against a property that secures payment of a debt or obligation. An involuntary lien, unlike a voluntary lien, is imposed by law, regardless of the property owner’s consent or agreement.

Involuntary liens are typically created by statute or court order and can arise in various situations, such as unpaid taxes, unpaid child support, or judgments in legal proceedings.

Legal Basis for Involuntary Liens

The legal basis for involuntary liens varies depending on the specific type of lien and the jurisdiction in which it is imposed. However, generally, involuntary liens are authorized by statutes or court rules that provide for the creation and enforcement of such liens in specific circumstances.

For example, tax liens are typically authorized by statutes that grant the government the right to impose a lien on property to secure unpaid taxes. Similarly, child support liens are often created by court orders that require a parent to pay child support and provide a lien on their property as security for the payments.

Types of Involuntary Liens

Involuntary liens are legal claims imposed on a property without the owner’s consent. They can arise from various situations, including unpaid debts, taxes, or judgments. Here are some common types of involuntary liens:

Tax Liens

Tax liens are imposed by government agencies to secure unpaid taxes. They attach to all the taxpayer’s properties and can be enforced through foreclosure if the taxes remain unpaid.

Mechanic’s Liens

Mechanic’s liens are imposed on properties by contractors, subcontractors, or suppliers who have not been paid for their work or materials. These liens secure the payment of debts related to construction or renovation projects.

Judgment Liens

Judgment liens are imposed on properties when a court issues a judgment against an individual or entity. They secure the payment of damages or other amounts owed as per the court’s order.

Homeowners Association (HOA) Liens

HOA liens are imposed on properties by homeowners associations to secure unpaid dues, assessments, or fines. These liens can be enforced through foreclosure if the charges remain unpaid.

Priority of Involuntary Liens

Involuntary liens are prioritized among themselves based on the concept of “first-in-time, first-in-right.” This means that the lien that was created first has priority over liens that were created later.

However, there are some exceptions to this general rule. For example, a tax lien may have priority over a prior mortgage lien. Additionally, a mechanic’s lien may have priority over a prior mortgage lien if the mechanic’s lien was filed within a certain period of time after the work was completed.

Exceptions to the General Rule of Priority

- Tax liens may have priority over prior mortgage liens.

- Mechanic’s liens may have priority over prior mortgage liens if the mechanic’s lien was filed within a certain period of time after the work was completed.

- Liens created by statute may have priority over liens created by contract.

Enforcement of Involuntary Liens

Involuntary liens can be enforced through a legal process known as foreclosure. During foreclosure, the lienholder takes steps to sell the property subject to the lien to satisfy the debt owed.

An involuntary lien, in a nutshell, is a legal claim against your property without your consent. Interested in delving deeper into the intricacies of involuntary liens? Check out the unit 3 ap psychology vocab for a comprehensive exploration of this and other related concepts.

The foreclosure process varies depending on the type of lien and the jurisdiction in which the property is located. However, it typically involves the following steps:

Notice of Default, What is a involuntary lien

The lienholder sends a notice of default to the property owner, informing them that they have failed to meet the terms of the underlying debt and that foreclosure proceedings will begin if the debt is not paid.

Foreclosure Sale

If the property owner does not cure the default within the specified time period, the lienholder may proceed with a foreclosure sale. The property is sold at a public auction, and the proceeds are used to satisfy the debt owed.

Rights of the Lienholder and Property Owner

During the foreclosure process, the lienholder has the right to pursue the sale of the property to satisfy the debt. The property owner has the right to contest the foreclosure and to redeem the property by paying the debt in full before the foreclosure sale.

Removal of Involuntary Liens: What Is A Involuntary Lien

Involuntary liens can be removed once the underlying debt or obligation has been satisfied. There are several methods for removing an involuntary lien, including:

Payment

The most straightforward method of lien removal is to pay off the debt that gave rise to the lien. Once the debt is paid in full, the lienholder is obligated to release the lien.

Satisfaction

In some cases, an involuntary lien may be satisfied without payment. For example, if the property subject to the lien is damaged or destroyed, the lien may be satisfied by the insurance proceeds.

Release

A lienholder may also release an involuntary lien voluntarily. This can occur for a variety of reasons, such as a settlement agreement or a mistake in the filing of the lien.

Q&A

What is the difference between a voluntary and involuntary lien?

Voluntary liens are created with the consent of the property owner, while involuntary liens are imposed without their consent due to unpaid debts, taxes, or legal judgments.

What are the different types of involuntary liens?

There are various types of involuntary liens, including tax liens, judgment liens, mechanic’s liens, and statutory liens.

How can I remove an involuntary lien from my property?

Involuntary liens can be removed through payment, satisfaction of the underlying debt, or release by the lienholder.